Transform Your Banking and Insurance Business with HubSpot CRM & AI-Powered Solutions

HubSpot for Banks, Insurance, and Financial Services: AI-Powered CRM Solutions

At N/C, we specialise in helping banks, financial institutions, insurance providers, and insurance agents optimise operations and drive measurable growth using HubSpot CRM and advanced AI solutions. As an Elite HubSpot Partner, we offer end-to-end onboarding, tailored implementation, expert training, and ongoing support to ensure your team gets the most from the platform.

Whether you're managing a local bank branch, a national insurance provider, or an independent insurance agency, our solutions provide a seamless, AI-powered CRM infrastructure that enhances account management, client engagement, and overall operational efficiency. With HubSpot and AI, financial teams can automate workflows, personalise client communications, and gain actionable insights to deliver exceptional service while driving revenue growth.

Contact Us

AI for Banking, Finance & Insurance: Intelligent Solutions for a Smarter Financial Future

At N/C, we help banks, financial institutions, and insurance providers harness the transformative power of AI for finance - building intelligent, compliant, and customer-centric systems that drive sustainable growth. As a leading AI consultancy for banking and insurance, we combine deep industry expertise with advanced automation and analytics to streamline operations, strengthen compliance, and create more meaningful customer engagement.

Our AI solutions for finance enable your organisation to predict behaviour, mitigate risk, and deliver personalised experiences at scale. From AI-powered risk and fraud detection to automated underwriting, policy processing, and claims management, our solutions eliminate inefficiency and enhance accuracy - ensuring faster decisions and better outcomes.

Through AI in financial marketing, we help you reach customers with precision - using predictive analytics, intelligent segmentation, and real-time personalisation to improve acquisition, retention, and cross-selling performance. AI-driven chat and WhatsApp agents enhance service by responding instantly to enquiries, providing updates, and guiding customers with empathy and accuracy - all while maintaining full compliance.

At N/C, we don’t deliver off-the-shelf automation; we design intelligent ecosystems aligned to your strategic priorities. Whether you’re a high-street bank, fintech lender, or global insurer, we partner with you to build scalable, AI-powered frameworks that unlock efficiency, strengthen trust, and future-proof your operations.

Because in today’s financial landscape, intelligence isn’t optional — it’s your competitive advantage.

Contact Us

Why HubSpot and AI Are Essential for Banks and Insurance Businesses

Using HubSpot for Banks and HubSpot for Insurance Agents, you can centralise client data, manage accounts, track interactions, and deliver personalised experiences at scale. Combined with AI solutions, HubSpot allows you to:

- Automate onboarding, renewals, and follow-ups

- Personalise communication and offers for clients and policyholders

- Optimise marketing campaigns for higher conversions

- Gain real-time insights into customer behaviour and portfolio performance

- Reduce manual administration, freeing staff to focus on advisory and relationship-building

Integrating HubSpot and AI ensures financial businesses can streamline operations, improve client satisfaction, maintain compliance, and drive measurable revenue growth.

How N/C Helps Banks and Insurance Businesses

Some of Our Finance and Insurance Work

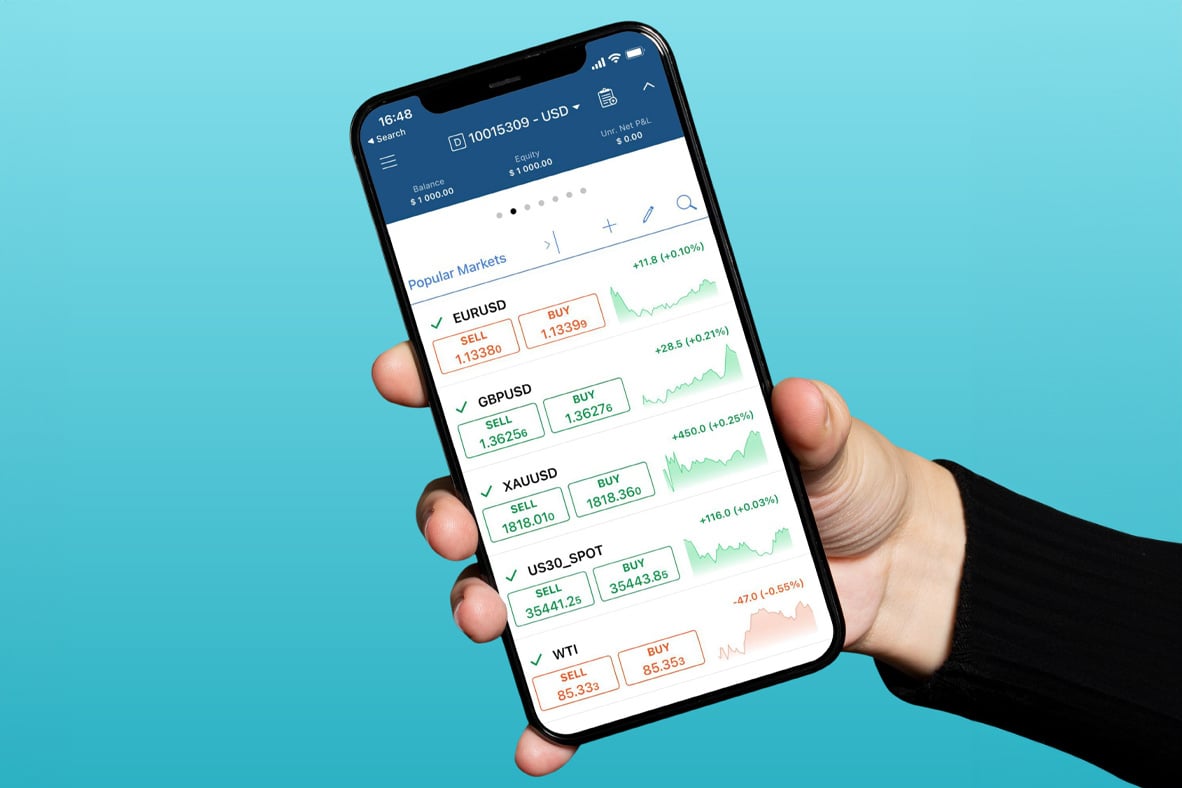

CFI

CFI, a global leader in credit and investment services, faced challenges integrating its complex tech ecosystem, which included a bespoke trading platform, custom CRM, and mobile app. To streamline operations, N/C developed a tailored HubSpot integration that unified these systems, ensuring seamless connectivity and efficient workflows. This solution empowered CFI's teams to leverage HubSpot's full potential, enhancing their operational efficiency.

The project involved eight in-depth workshops with CFI's stakeholders, allowing N/C to design a bespoke solution that met the company's unique requirements. Comprehensive HubSpot training was also provided to ensure CFI's team could manage and optimise the platform independently. The integration delivered quick wins and set the stage for long-term success, earning N/C a post-engagement Net Promoter Score (NPS) of 9/10 from CFI, reflecting high customer satisfaction with the solution provided.

Alllianz Travel

Allianz Travel, a leading provider of international travel insurance, partnered with N/C to enhance their online presence and increase insurance purchases in the UAE. Faced with a competitive market and decreased search volume during the COVID-19 pandemic, Allianz aimed to boost online sales with a limited advertising budget.

N/C implemented a Google Smart Bidding strategy, optimised high-volume keywords, utilised negative keywords, and designed high-converting landing pages. These efforts resulted in 1,670 online insurance purchases, generating a total conversion value of £95.46K and an impressive 366% return on investment. This campaign demonstrated the effectiveness of targeted digital marketing strategies in driving significant business outcomes.

Finductive

Finductive Ltd, a licensed financial institution regulated by the Malta Financial Services Authority (MFSA), offers innovative financial services across the European Economic Area. As client demand and operations expanded, Finductive sought to future-proof their digital infrastructure by integrating HubSpot as a centralised CRM and marketing automation solution. The goal was to optimise communication with clients while building a system flexible enough to reflect their unique user structure.

To address the challenge of managing multiple users under one email address, which complicated segmentation and marketing personalisation, N/C developed a HubSpot configuration using Custom Objects and Customer IDs. This approach enabled Finductive to distinguish users, automate segmentation, and facilitate efficient, compliant communications with reduced manual overhead. The result is a scalable CRM infrastructure that supports enhanced personalisation, automated campaign delivery, and regulatory compliance, positioning Finductive for long-term success.

Revolutionise your Finance and Insurance business with HubSpot and AI

Frequently Asked Questions

A tailored CRM and marketing platform designed to manage accounts, policies, customer communications, and marketing campaigns in one centralised system.

By centralising interactions, automating communications, and enabling personalised offers, HubSpot ensures consistent and efficient engagement across all client touchpoints.

Yes. HubSpot workflows can handle onboarding, renewals, reminders, and follow-ups, improving efficiency and compliance.

AI provides predictive insights, segments clients for personalised campaigns, automates workflows, and identifies upsell or cross-sell opportunities.

Absolutely. HubSpot integrates with core banking systems, insurance policy management tools, and payment platforms for seamless operations.

Yes. HubSpot scales to businesses of all sizes, offering essential CRM features for small agencies and enterprise-level capabilities for large banks.

Automation and workflow benefits are immediate, while measurable improvements in conversions, retention, and efficiency typically appear within 3–6 months.

N/C provides ongoing support, workflow optimisation, team training, and strategic consultancy to ensure your HubSpot system continues to deliver value.

Yes. HubSpot allows you to create targeted campaigns via email, social media, and websites, track performance, and optimise messaging to attract and retain clients.

As an Elite HubSpot Partner, N/C combines deep financial industry expertise with technical HubSpot and AI knowledge, delivering tailored solutions that streamline operations, enhance client engagement, and drive revenue growth.

An AI consultancy in this sector assesses your current operations, identifies high-impact use cases (such as underwriting automation or fraud detection), and implements tailored AI solutions for finance that improve efficiency, reduce risk and enhance customer engagement.

Through predictive modelling, automated lead scoring and personalised engagement, AI enables financial firms to identify high-value prospects, deliver targeted offers and retain clients by detecting churn-risk signals earlier and acting proactively.

Yes - our services scale. We design modular AI for insurance agents solutions that fit smaller firms, delivering automation and insight without heavy infrastructure burdens, enabling every financial organisation to access the benefits of intelligent systems.

Regulators such as the Financial Conduct Authority (FCA) emphasise governance, transparency and accountability for AI in financial services. Firms must ensure fairness, explainability and robust controls - all of which we embed in our AI consultancy for banking and insurance.

Security is paramount. Our AI solutions for financial services include encrypted data handling, strict access controls, auditable model behaviour and governance frameworks designed to align with financial-industry standards and regulatory expectations.

Many firms begin to see improvements - such as faster underwriting or quicker claims processing - within the first 3-6 months. Our consultancy-led approach focuses on early wins while building a scalable, long-term AI ecosystem.

No - the goal is augmentation, not replacement. AI enhances human capabilities by automating repetitive tasks, highlighting high-value opportunities and providing decision-support insights. This allows advisors and underwriters to focus on complex and strategic work.

AI-powered chatbots and virtual assistants provide 24/7 support, expedite enquiry handling and personalise communications. These tools improve responsiveness and customer satisfaction, freeing human teams to focus on relationship-building and exception management.

As a specialist AI consultancy for financial services, N/C combines deep industry knowledge with AI strategy, implementation and optimisation. We help banks, insurers and agents build intelligent frameworks that deliver measurable results - agile, compliant and aligned to your business goals.

Our clients rely on us for impactful business solutions

Real Businesses, Unmatched Results

.png)

.png)

.png)

.png)

Client Success, Our Priority

It's been a great experience to partner with Nexa Cognition on implementing smarter ways of working with HubSpot. The sessions were really useful, with lots of bonus insights on sales and marketing approaches. Following it, the support on a day-to-day basis has been fantastic, so many learnings and tips on how to make the most of the platform. They're real experts and the positive attitude makes the whole difference.

Martins dos Santos

We had a one-on-one training session with Nexa Cognition focused on improving our data quality and record management. Monica was fantastic from start to finish and the session was tailored to our needs. She is extremely knowledgeable and experienced and gave us best practices and industry tips. The follow-up support was also invaluable, helping us to problem solve queries in the system.

Susann Yung

Nexa Cognition has been really good at understanding our needs and the specificities of our audience and sales process. They helped in the whole sales and marketing journey from the website design, the CRM implementation, the digi- tal Marketing to the lead nurturing. They made the HubSpot user experience easier and fluid.

Kadiri, L

Nexa Cognition has supported the growth of Pure Minds Academy since 2016, which is when they convinced us that the commercial foundations of our business should be built using HubSpot. Not only has every iteration of our website been on this platform but today we use the full marketing, sales and customer service features as well. The team at Nexa Cognition has also trained us so that day to day website management (including the creation of new pages), landing pages, email marketing, campaigns and even social media posts and publishing are managed by our small team. All in all, from branding to genuine business growth, the team and I can't recommend Nexa Cognition highly enough

C,A.

Their proficiency in HubSpot CRM set-up and migration is unparalleled, and their unwavering commitment to excellence has made them stand out as one of the best agencies I've ever collaborated with. From the very beginning, Nexa Cognition displayed an unmatched level of attentiveness and dedication. Despite the complexity of the task, Nexa Cognition tackled it with finesse and professionalism, assuring us that we were in capable hands.

EL Shabrowy

Nexa Cognition completely rebuilt our approach to sales through utilising HubSpot and its features limited to our currently license. They understood clearly our pain points and requirements and delivered a solution which will help us grow as an organisation now for the foreseeable. Shout out to Gary, Sam, Aman & Heena for their great professionalism and support!

Walker, M.

The team at Nexa Cognition have been an excellent partner to our business, starting by the re-branding and launch of our new website. We now work with them to grow our footprint and brand in the market, with a variety of approaches. They are a creative and dedicated team, who are great to work with. Their knowledge of HubSpot has been extremely valuable to us getting the most out of the software to help our business achieve its goals.

Imogen Conyers

Start Your Growth Engineering Journey

Build the systems, strategy, and AI that power scalable growth.

NC helps mid-market and enterprise businesses connect data, teams, and technology to drive predictable performance.

We engineer the platforms and intelligence that make growth repeatable.

Human strategy. Engineered intelligence. Real results.

.png?width=126&height=73&name=CN_logo-update%20(2).png)

.png?width=512&height=512&name=whatsapp%20(2).png)